Let’s Discuss the V.L.Infraprojects Limited IPO As Company registered at Ahmedabad in the year 2014. It was earlier named V. L. Infrastructures and was established in the year 2013-14 by Mrs. A Mydhili Reddy, who is now one among the Director of V. L. Infra projects Limited.

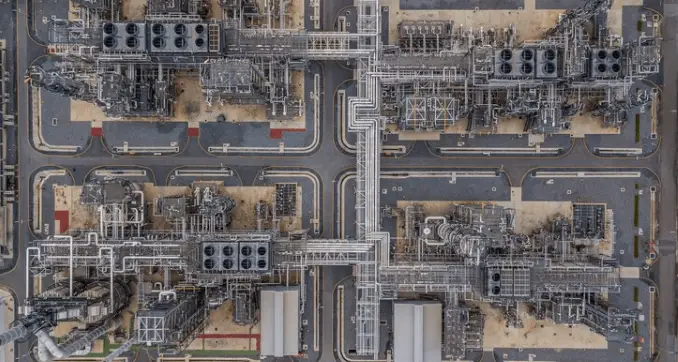

The company was founded on the premise of setting new benchmarks for infrastructural growth and development and chiefly deals in Residential Building, Road, Irrigation, Water supply, and Gas Supply. With our specially recruited team of professional managers alongside the best technologies and a customer-oriented strategy, we are in a position to deliver more than expected and create values for every stakeholder of the company.

Quality, safety and Environment Protection are our core values and at VL Infra projects Limited, we provide strategic solutions with reference to the mentioned values. Here at Nord, we establish partnerships and promote innovation as key principles permeating our mission to be leaders in the pursuit of change and innovation in infrastructures’ development.

Details of V.L.Infraprojects Limited IPO

V.L.Infraprojects Limited IPO again becomes a book built issue for the capital of Rs 18. 52 crores. The problem is fresh and it affects 44. 1 lakh shares.

V.L.Infraprojects Limited IPO Opening Date of the issue is July 23, 2024, and the closing date of the issue is July 25, 2024. Inasmuch as the retail investors’ category, there is anticipation that the allotment for the V.L.Infraprojects Limited IPO will be determined on Friday, July 26, 2024. Eligible investors in V.L.Infraprojects Limited IPO will be able to buy the shares on NSE SME with the expected listing date of Tuesday, July 30, 2024.

V.L.Infraprojects Limited IPO is coming up with its IPO which is in the price band of ₹39 to ₹42 per share. As for the minimum lot size an application, at least 3000 Shares is required. The quantum of investment that has been suggested by this regulation is the bare minimum of ₹126000 for retail investors. While the minimum lot size investment of the institutional investor n HNI/BMA is 2 lots costing ₹ 6,000 which is equal to 2,52,000 shares.

Important Dates of V.L.Infraprojects IPO

V.L.Infraprojects Limited IPO opens on July 23, 2024, and closes on July 25, 2024.

| IPO Open Date | Tuesday, July 23, 2024 |

| IPO Close Date | Thursday, July 25, 2024 |

| Basis of Allotment | Friday, July 26, 2024 |

| Initiation of Refunds | Monday, July 29, 2024 |

| Credit of Shares to Demat | Monday, July 29, 2024 |

| Listing Date | Tuesday, July 30, 2024 |

| Cut-off time for UPI mandate confirmation | 5 PM on July 25, 2024 |

Promoter Holding of V.L.Infraprojects Limited IPO

Mr. Rajagopal Reddy Annam Reddy, Mrs. Mydhili Rajagopal Reddy, and Mr. Nageswara Rao Repuri are the company’s promoters.

| Share Holding Pre Issue | 90.91% |

| Share Holding Post Issue | 65.39% |

Financial Information of V.L.Infraprojects Limited IPO

V.L.Infraprojects Limited IPO revenue increased by 149.72% and profit after tax (PAT) rose by 175.76% between the financial year ending with March 31, 2024 and March 31, 2023.

| Period Ended | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 | 31 Mar 2021 |

| Assets | 5,691.39 | 2,836.24 | 1,955.40 | 1,641.29 |

| Revenue | 11,400.05 | 4,565.14 | 3,560.70 | 3,077.57 |

| Profit After Tax | 614.01 | 222.66 | 110.58 | 83.37 |

| Net Worth | 1,636.01 | 1,022.00 | 730.84 | 620.26 |

| Reserves and Surplus | 505.76 | 268.50 | 456.84 | 346.26 |

| Total Borrowing | 1,654.81 | 999.02 | 1,003.52 | 659.41 |

| Amount in ₹ Lakhs | ||||

Vision of V.L.Infraprojects Limited IPO

To achieve and retain the position of most valuable infrastructure development by delivering products and solutions which meets global standards and thus creating values.

Mission of V.L.Infraprojects Limited IPO

Empowering communities through innovative infrastructure solutions, V.L.Infraprojects Limited IPO envisions a future where sustainable development fosters prosperity for generations to come.

Industry Overview

Indian Infrastructure Sector

The Indian infrastructure industry has significant potential for expansion in terms of government-support and rising role of the private participants. The government’s policies towards development and up gradation of roads and bridges, along with development of urban related structures and facilities are the two major factors that holds good number of opportunities for companies such as V. L. Infraprojects.

Competitive Landscape

In the infrastructure industry there are many competitors which offer their services in contracts. V. L. Infraprojects finds itself in competition with large players, or big players and niche players alike. Single or combined, large-scale projects demonstrate the kind of distinction that the company has over many of its rivals.

Regulatory Environment

The factors related to the regulatory environment, the laws governing the infrastructure industry in India are quite favourable for infrastructure development with fairly easy procedures for project clearances and attractive policies for private participation. However, the compliance laws and duty regarding environmental issues prior the project implementation could be a great challenge to most organizations.

Investment Considerations

Strengths

1. Track Record of Success: V. L. Infraprojects has implemented and delivered its projects on time and within reasonable costs which increases its reputation ans credibility.

2. Diversified Portfolio: The diversified project portfolio of the company helps to eliminate the risk factors and constant stream of cash inflow.

3. Experienced Management: Strong corporate management experienced in the sector delivers the company’s strategy and satisfactory business performance.

Risks

1. Economic Slowdown: Factors of global economic fluctuations mean that there can be a prevailing slowdown in infrastructure investment that can be detrimental to the company because it might start losing some of the contracts or portions of projects in which it is involved to other companies or because it has to scale back on its infrastructure investments, which can in turn limit the flow of revenues into the business.

2. Regulatory Changes: Government policies and regulatory structures might change and this will present some forms of risks to the project execution.

3. Competitive Pressure: A lot of competition in this industry may force the organizations to experience margin squeeze, hence profitability.

Conclusion

This is specifically evident the V.L.Infraprojects Limited IPO is a good example for those who want to invest in India’s infrastructural growth. Having delivered a commendable performance in the recent past with stable financial profiles and visionary expansion strategies, the firm is poised to benefit from the growing demand for infrastructure upgrades in the country. But for investors, they need to analyze the business risks that come along with it and general market conditions prevailing at that time. To understand what is IPO Click here.

How to Apply V.L.Infraprojects IPO through Zerodha?

This Step 1: Login to Zerodha Console

You need to open your browser and visit the Zerodha website: https://console.zerodha.com

Sign in with your security details: Zerodha user ID, password, and PIN to log into the account.

Step 2: Go to the work and finds for IPO section.

Visit Portfolio: After logging to your account, click on the tab ‘Portfolio’ available in left-hand side menu.

Direct to ‘IPO’: Click on ‘Portfolio’ and then click on the ‘IPOs’in blue as marked below from main menu.

Step 3: Choose the V.L.Infraprojects IPO

IPO: Take List =>Click on the IPO, Find from a list “Three M Paper Boards Limited”

Click on ‘Apply’: After you select V.L.Infraprojects IPO it will take to the next page where he/she needs to click (on one of Bid Details Radio button) as shown in above image and then finally at bottom after Terms & Condition, Demat No etc. Click On Apply

4. On the next screen, fill in your Application Details

UPI ID : In application form, you have to enter your UPI ID To do so make sure your UPI ID is linked to the Bank account having an equivalent asset glossed with amount payable.

Bid Details: Fill in the number of shares you want to apply for, and bid price You may opt for cut-off price and apply using the ‘Cut Off’ parameters.

Verify Your Information: Review all information entered to make sure it is accurate

Step 5: Fill out and submit the Application

Step 4:Click Submit: After entering all the mandatory details, click on submit button.

Mandate on UPI: You will receive a mandate request in your UPI app. You need to login using your mobile app and approve the mandate for blocking funds required for IPO application.

Step 6: Verify Your App

Once you have successfully validated the UPI mandate your IPO application will be submitted. 3) Check status: Where can you see the status of your application;”’goto my order ==> IPO & check in Order Book section