Option Chain of Bank Nifty trading scene is incredibly complex and intriguing, leaving a whole world of options for traders wanting to diversify their portfolios or simply looking for ways to manage risk. In the options segment, Anchor Nifty is a center of high liquidity coupled with wide swings for providing alluring opportunities in strategy. The same article we dive into the details of Bank Nifty option chain which serves as step by step guide to facilitate various traders and investors tackle through this vibrant market.

What is Bank Nifty?

The Nifty Bank Index is also known as the BANKNIFTY. this index consists of all liquid and large capitalized banking stocks listed on the National Stock Exchange (NSE). It acts as the measuring rod for banks performance in India; reflecting changes and studs prevalent market sentiments, economic conditions having an impact on financial institutions.

Understanding Option Chain of Bank Nifty

What are options – read this before reading Bank Nifty option chain?: Options are financial contracts that offer the holder of an option the ability, but not obligation to buy or sell an underlying asset at a predetermined price (strike price) on before/after some specific date (expiry date). There are two types of options,

Call Options – Enables the holder to buy the underlying asset.

Put Options – These gives the holder the right to sell the underlying asset.

Option Chain: An Overview

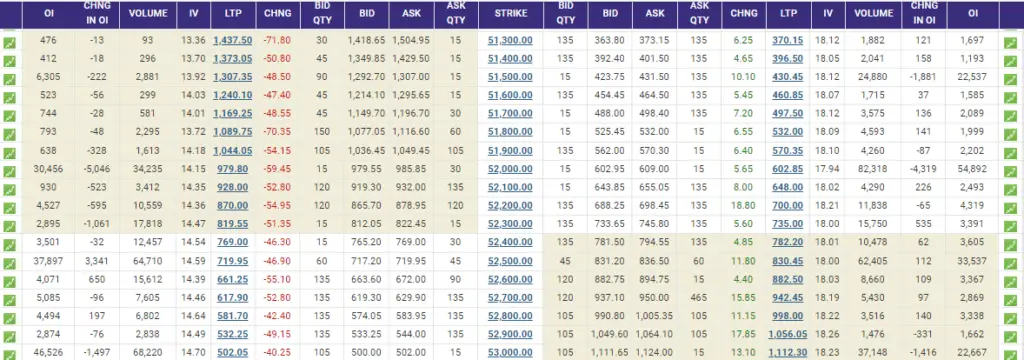

An option chain, which also operates as an options matrix, is a listing of available option contracts for the underlying asset they apply to by their maturity and strike prices. Contract wise Details: it contain the bid price, ask price, Last traded Price open Interest and volume for each strike column in separately available therefore we find these details by selecting specific Strike (row) price. An option chain is an important tool to analyze market sentiments, finding potential trade ideas and making trades.

Components of the Bank Nifty Option Chain

The Bank Nifty option chain comprises various elements that provide valuable insights into the market’s behavior. These components include:

1. Expiry Dates: Options come in expiry dates that could be weekly, monthly or quarterly. So, first of all traders will be required to choose a proper expiry time depending on their trading test and trade timeline.

2. Strike Prices : The prices at which the option buyer can purchase (call) or sell (put) the underlying asset. Option chain lists the different strike prices higher and lower than bank nifty current price

3. Premiums: An option premium is the price paid by investor for an options contract to a seller or writer of call or put(peace)option. An option price is the sum of intrinsic value (the difference between the current, or in-the-money, market level and strike) + extrinsic value (or time premium or implied volatility).

4. Open Interest (OI): Open interest is the number of unliquidated option contracts at a particular strike price and expiry date. This is the measure of market activity and liquidity.

5. Volume :- Volume is an indication of the number of option contracts traded during a time frame. A high volume relates to lots of action from traders gunning for a stock.

6. Implied Volatility (IV): This represents the market expectations of volatility in a particular stock. A higher IV generally equates to a higher option premium which reflects more uncertainty or expected price movements.

Analyzing the Bank Nifty Option Chain

1. Open Interest Analysis

It open interest analysis helps traders know where the significant positions are being built. Options: A large open interest at a given strike works as strong support or resistance For instance, a high open interest of call options at certain strike prices may imply that traders believe the price is likely to be capped near this level.

2. Volume Analysis

Volume analytics can offer information on the trading volume and focus directed towards a given strike price. Furthermore, a spike in volume for a given strike price could suggest more interest and thus potential movement in that direction. Looking at volume per strike prices and expiration dates can be one useful signalling point to see the overall trends.

3. Implied Volatility Analysis

In options pricing, implied volatility (IV) plays an essential role. IV analysis allows traders to gauge the anticipated extent of future volatility by market and adjust their strategies accordingly. High IV = high option premium Low IV = low option premium Keeping an eye on changes in IV can also indicate when shifts of sentiment and possible moves may happen.

4. Put-Call Ratio (PCR)

The put-call ratio is the well known metric that compares puts vs. calls on traded options. PCR mainly confirms bearish sentiment in a bull market and bullish sentiments are restricted to consolidations, However TR and PCR may not be comparable. The key for traders is to use the PCR as an exciting and interesting tool that can be analyzed to get information on where market sentiment will lead us next with regard reversal or continuation patterns.

5. Max Pain Theory

This theory has to do with the idea that when there are large numbers of options which have been opened, in a simple way it states generally through observation and testing over time traders will note: The price action on an individual stock or index is prone/structurally moves toward where at expiry not just one side (calls) but Both sides (in totality volume/open interest terms both puts + calls = max pain) from our little game end up exercise worthless. This level, popularly referred to as the max pain point, is said not be in any discomfort for both option buyers and sellers from a financial perspective. The max pain point can help in identifying price target and support/resistance levels.

Conclusion

This article will explore each part of the option chain of Bank Nifty, which is critical for those traders and investors looking to understand options trading in this top index; Through the Option Chain we can say a lot about how is the market sentiment on an underlying instrument, possible price actions having some clarity and that gives us levels of supports & resistances. Traders can build strategies using open interest, volume and strike prices to avoid risk but take benefit out of market opportunities.

The overall take away would be to keep an eye on Open Interest as the market sentiment tracker, work with Volume data put its weight behind a Price move and especially trades-activity at certain Strike Prices may hint toward Similar levels in Price going ahead. Further, knowing the volatility and expiry cycles can better plan Bank Nifty options trades.

we can say, learning the option chain of Bank Nifty gives traders an edge to realizing what they can do next as well it would help optimize one’s trading strategy and make them successful in more ways that is not possible in Options market. Through ongoing exploration, and by using what you have learned through the option chain, traders can more accurately predict market movement and ultimately meet their trading goals.

What is an option chain?

An option chain is a listing of all available option contracts for a particular underlying asset, organized by strike price and expiration date.

What does the option chain of Bank Nifty show?

The option chain of Bank Nifty displays all available call and put option contracts, their strike prices, premiums, open interest, and expiration dates.