Introduction

Kataria Industries Limited going to launch its Initial Public Offering soon, the stock market has high expectation for this IPO. The well-diversified and financially strong company is coming soon to the public market in order to fundraise for expansion as it looks to reduce its debt. In this article, we will unfold the fine print of Kataria Industries Limited IPO such as its objectives, financial performance, risks and scope it holds for potential investors.

Company Overview

About Kataria Industries Ltd

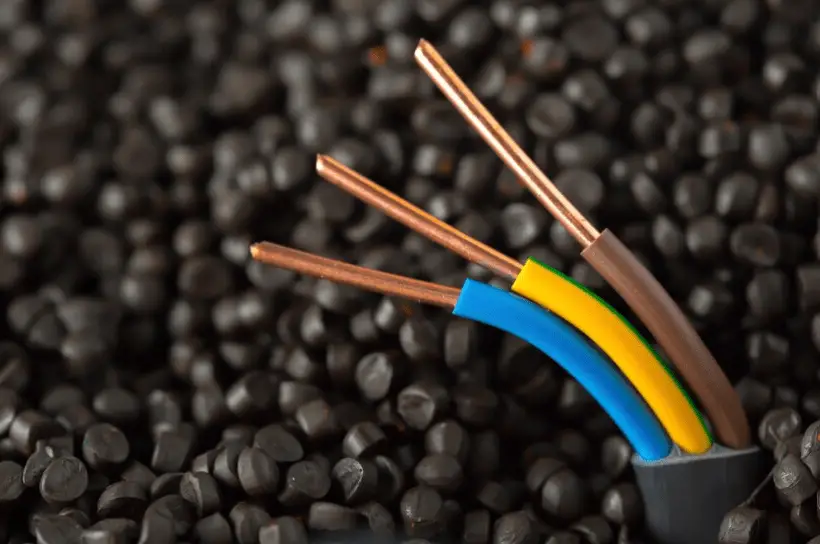

The epitome of raw power and endurance to withstand for wires& strands. Our new brand reflects our true self in the market, a fearless no bullshit-attitude tied with tenacity & innovative technology. We are one of the nation’s top manufacturing organizations with over 50 years’ experience. More Our Products LRPC Strands Steel Wires Cables Conductors We are experts in operating across sectors like Infrastructure and Road Bridges, Metros and Real Estate, Construction & Power to Energy & Agriculture, etc. enhancing the value of each project we deliver.

Kataria Industries Ltd, powered by its unwillingness to compromise quality, strive for innovation and remain committed uncompromisingly towards customer satisfaction reviles in pride as we look forward fiercely marching ahead with the same zeal & confidence along to take on more challenges along our pioneering journey.

Crafting better products is one side of the coin but our commitment does not end there. We are guided by commercial ethics, with social and environmental aspects at the core of our production. With our powerful technology capabilities and strong financial position, we not only serve the various needs of our consumers but also have a positive impact on society.

Tentative Details of Kataria Industries IPO

Kataria Industries IPO opens on July 16, 2024, and closes on July 19, 2024.

| IPO Open Date | Tuesday, July 16, 2024 |

| IPO Close Date | Friday, July 19, 2024 |

| Basis of Allotment | Monday, July 22, 2024 |

| Initiation of Refunds | Tuesday, July 23, 2024 |

| Credit of Shares to Demat | Tuesday, July 23, 2024 |

| Listing Date | Wednesday, July 24, 2024 |

| Cut-off time for UPI mandate confirmation | 5 PM on July 19, 2024 |

Financial Details of Kataria Industries Limited

Kataria Industries Limited’s revenue increased by 2.26% and profit after tax (PAT) rose by 28.83% between the financial year ending with March 31, 2024 and March 31, 2023.

| Period Ended | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 12,002.84 | 15,058.73 | 12,787.19 |

| Revenue | 34,148.63 | 33,393.09 | 25,048.91 |

| Profit After Tax | 1,002.11 | 777.83 | 738.34 |

| Net Worth | 4,549.56 | 3,584.16 | 2,806.33 |

| Reserves and Surplus | 3,001.58 | 3,320.05 | 2,542.21 |

| Total Borrowing | 6,337.11 | 10,696.20 | 9,142.29 |

| Amount in ₹ Lakhs | |||

Promoter Holding of Kataria Industries IPO

The promoters of the company are Sunil Kataria, Arun Kataria and Anoop Kataria.

| Share Holding Pre-Issue | 100.00% |

| Share Holding Post Issue |

Objectives of the IPO

Main Objects of the Kataria Industries Limited IPO are:

To fund expansion plans: The company wants to spend a portion of its proceeds on expanding, specifically the Cos that as such includes setting up new manufacturing units; and upgrading existing facilities with exploring into newer markets.

Repayment of debt: A certain amount will go for repaying existing debt which in turn proves beneficial by reducing the financial liability and improving balance sheet.

General Corporate Purposes: The balance of the proceeds will be used for general corporate purposes, allowing it to satisfy its working capital and other business needs.

Risks Associated with the IPO

Anytime you invest in an IPO, it is a risky proposition. However, investors may note below risk factors while taking an investment decision for Kataria Industries Limited IPO public issue.

Market Volatility: Stock market is volatile in nature which ultimately can affect the performance of listing of IPO.

Risk on regulatory: This risk comes from the changes in government policies and regulations making an impact to the operations of a company, it can affect its profitability.

Supply and operational risks: The cashmere manufacturing business is inherently exposed to the risk of supply chain disruptions, as well as movements in raw material prices or even new automation technology.

Economic Conditions: Unfavorable economic conditions could reduce consumer spending and business investments, which would lower the company’s revenues.

Conclusion

Kataria Industries Limited IPO gives an excellent opportunity for the investors who are looking to invest in a company which has established business and with diverse range of businesses. The stock is about to IPO, and with these funds planned for the expansion together with debt reduction in mind, it looks well positioned for potential growth. Nevertheless, the risks are likely to be substantial and prospective investors should conduct detailed due diligence before making investment decisions.

With the landscape of IPO market is transforming, there are indeed high expectations surrounding Kataria Industries Limited going public for this would be a major step as the company charts its growth journey. For you seasoned investor or stock market newbie, understanding this IPO in and out will only benefit your investment knowledge so that you make the right decision.

How to apply Kataria Industries IPO trough zerodha?

STEPS to login in Zerodha Console

Step 1: Go-to the console page of zerodha. Then Click on log in to your account Enter this Zerodha user ID, password and PIN access you account.

Step 2: Go to the IPO Segment

Step 3: Visit the ‘Portfolio’: After login click on Portfolio tab, available at left side menu.

Step 4: IPO search Click on ‘IPO’ which is under the tab of Portfolio to view a list comprising all active IPOs.

Step 5: Click on the Kataria Industries IPO

Search the IPO: You can filter by Kataria Industries IPO and search from a list of available public offerings.

Finally, click on ‘Apply’: Upon finding Kataria Industries IPO you just need to select Apply (along with Submit after entering the input details).

Step 6: Type your Application Details

In the application form, you have to enter your UPI ID : Enter Your UPI Id Once added the UPI ID, it can link to a bank account which have enough balance for applying.

Bid Quantity: Qty Enter Number of shares Qty up to Bid Price, Integer only Click on the option ‘Cut-off’ to apply at cut-off price.

Check your field details: Review All the accurate information entered

Step 7: Apply for the position

Submission: After filling all these opportunity click on the submit button as shown below.

UPI Mandate: There you will get a UPI mandate request in your UPI app. Open the app and confirm the mandate to withhold funds for IPO application

Step 8: Trust the Process

Verify the status: After you have accepted a UPI mandate, your IPO application will be submitted successfully Processed Petition available in the IPO tab under Order Book.