Introduction

Let’s discuss about The VWAP Trading Strategy so in trading, the ability to analyze and use market data is crucial. As such, market participants have access to a multitude of tools aimed at providing them with a competitive advantage. One such tool is the Volume Weighted Average Price used as a benchmark by institutional traders, this metric is also quite useful for retail investors. The purpose of the article is to examine the intricacies of the volume-weighted average price trading strategy. In detail, the article covers how this metric is calculated, its advantages and limitations, its application, and where it fits in the general trading scheme.

Overview of The VWAP Trading Strategy

Definition

Volume Weighted Average is an acronym for a volume-weighted average price. As a concept, it is defined as the specific price at which a particular security has been traded during the day, adjusted with the volume of each transaction. Notably, it is considered a valuable tool and has several practical applications. For example, institutional traders use it to determine the price they will be able to get when buying large numbers of shares. Since this action can potentially raise the share price, they use VWAP to sell at slightly higher prices.

Explanation

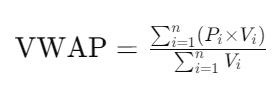

In terms of calculation, there are three general steps involved. Specifically, the first step requires multiplying the price by the number of shares traded to calculate the price-volume indicator and the second step – maintaining a total volume of shares traded throughout the day. The third and final step implies dividing the cumulative price-volume indicator by the shares’ cumulative number. Through the lens of an equation, the formula may look as follows:

- Pi is the price of the trade.

- Vi is the volume of the trade.

- n is the number of trades.

As an example, consider the following compensated illustration:

| Time | Price ($) | Volume |

| 9:30 | 100 | 200 |

| 10:00 | 102 | 150 |

| 10:30 | 101 | 300 |

| 11:00 | 103 | 250 |

Cumulative PV:

- 9:30: 100×200=20000100 \times 200 = 20000100×200=20000

- 10:00: 102×150=15300102 \times 150 = 15300102×150=15300

- 10:30: 101×300=30300101 \times 300 = 30300101×300=30300

- 11:00: 103×250=25750103 \times 250 = 25750103×250=25750

Total PV = 20000+15300+30300+25750=91350

Cumulative Volume:

- 9:30: 200

- 10:00: 150

- 10:30: 300

- 11:00: 250

Total Volume = 200+150+300+250=900

VWAP: 91350/900 = 101.5

Thus, the VWAP for this period is $101.5.

Why traders use VWAP

The volume-weighted average price is an easily calculated but powerful free trading indicator. It aids institutional trades by indicating average prices for securities. It is also used to identify trends in the market, as prices that are above the Volume Weighted Average indicate uptrends, whereas those that are below the volume-weighted average price signal downtrends. If it is handled carefully, it can also act as a focal price throughout the day to identify trade positions.

There are various reasons traders use the VWAP. They include the following:

- Benchmark for institutional trading: When institutions carry out big trades, it has the potential to influence market prices. Due to this, the Volume Weighted Average price empowers trading institutions to carry out deals near the average value to hedge market impact.

- Indicator of identifying trend: volume-weighted average price assists traders in identifying trends in the market. If prices are above the volume-weighted average price, it suggests an uptrend. Nonetheless, if the price is below the volume-weighted average price, it signals a downtrend.

- An intraday reference point: The volume-weighted average price serves as a significant point in changing trade position throughout the day.

Trading Strategies Using VWAP

volume-weighted average price Pullback Strategy

This tactic is utilized when it is trading in the path of the trend when the price moves back to the volume-weighted average price, as illustrated here:

1. Identify the trend of the security to be traded when prices are in an uptrend or a downtrend.

2. The trader waits for the security price to move again and contacts the volume-weighted average price.

3. Use the phone to place a trade in the direction of the trend.

4. Place a stop loss a little distance from the volume-weighted average price.

5. Lastly, choose the most recent high or low to take profits.

VWAP Crossover Strategy

It can be useful to deploy this approach by using volume-weighted average price as a moving average crossover plan, as shown through the steps below:

1. Buys the security that crosses over the volume-weighted average price underneath.

2. Sell the security if the security crosses below the volume-weighted average price from above.

3. Before any decisions made using the volume-weighted average price, use additional confirmation indicators like relative strength index and moving average convergence and divergence to avoid early signals.

VWAP and Volume Confirmation

VWAP in short for Volume Weighted Average Price is an indicator of price and volume. It is defined as a price level where the price itself is weighted by volumes of trade. It is calculated by multiplying each price level by volume at that price, adding all these numbers and dividing this sum by the total volume. The formula is as follows:

VWAP = SUM(price*volume) / SUM(volume)

This indicator has many important implications both for trading and execution.

This strategy uses volume to confirm how strong the price move is with regard to VWAP. So, the steps are the following:

- Identify whether the price is going in the same direction with VWAP.

- Volume should be advancing as the move is taking place.

- Enter a trade moving in the same direction.

- Use volume pattern to set entry and exit point.

VWAP in Algorithmic Trading

Programming of algorithmic trading uses VWAP the most for execution. Algorithms are used for splitting large orders to place smaller phased orders close to VWAP. By splitting trade like this the market impact is minimal.

VWAP Trading Advantages

Objectivity: VWAP is a purely objective criterion based on price and volume.

Market-neutrality: Traders can execute large trades without influencing the market due to the specifics of the notion.

Trend-identification: VWAP identifies an intraday trend as well as the potential turning points of it.

Benchmarking: The indicator can be very well used in performance evaluation especially by institutional traders.

VWAP Trading Limitations

However, VWAP is a lagging indicator which depends on the historical data so if the market is volatile the information may not be updated on time.

VWAP is not usable when trading low volume shares.

This indicator is suitable for intraday trading but not for the long term.

Enhancing the Strategy with Other Indicators

Combining with RSI

For example, the Relative Strength Index can identify when the market is oversold or overbought.

Combining with MACD

The Moving Average Convergence Divergence can add more weight to the trend direction whether it is up or down.

Case Study

Case Study 1: Institutional Order Execution

An institutional investor needs to buy 100,000 shares of a stock without significantly impacting the market price. By using VWAP, the trader can execute smaller orders throughout the day, ensuring the average purchase price is close to VWAP.

Case Study 2: Intraday Trading with VWAP

A day trader uses the VWAP pullback strategy to trade a trending stock. After identifying an uptrend, the trader waits for the price to pull back to the VWAP and enters a long position. The trade is exited at the recent high, resulting in a profitable trade.

Trading Platform

One can easily implement this indicator on such trading platforms as Meta Trader (just adding the indicator to “Insert-Indicators-Volumes-Volume Weighted Average price”, Thinkorswim, Trading View and many others. However, most of them offer automatic VWAP, so the trader will not be able to refine its settings to become as efficient as possible. Simultaneous operation with Volume Weighted Average price and any other indicators can also be a good method, for example, Bollinger Bands do not assure a buy or sell signal to be true, unless confirmed by VWAP.

Conclusion

However, one has to consider that Volume Weighted Average price, like any other indicator, has its own limitations and requirements for use, in particular, it requires inter-market monitoring and making trades based on an additional set of data.

What is VWAP?

VWAP is Volume Weighted Average Price, representing the average price an equity has trade throughout the day, based on volume

How is it calculated?

Volume Weighted Average price is calculated by dividing cumulative price-volume by cumulative volume within a time frame.

Why is VWAP important?

VWAP is important for institutional traders to make large transactions without changing the price. It also helps retail investors determine intraday price points.